Get an Electronic Equipment & Devices Insurance offer

Fast, Free and Personalized

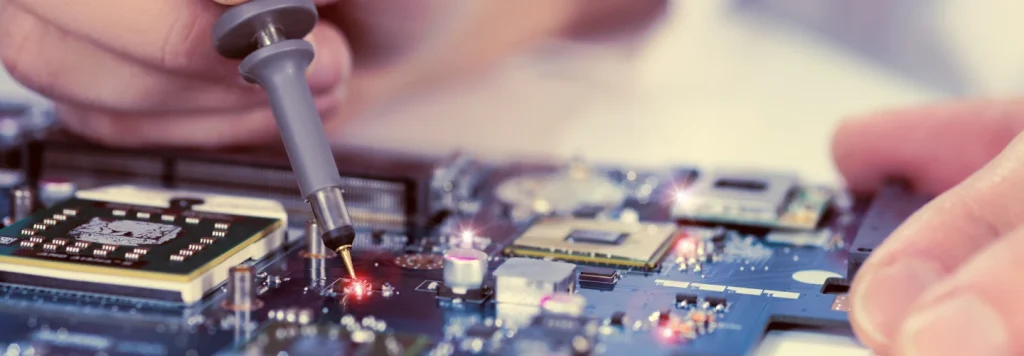

There is no doubt that technology is now an integral part of our lives. Computers, medical equipment, and communication systems are now essentials for modern life. Place your valuable equipment under Trust's shield with our comprehensive Owned or Rented Electronic Equipment Insurance Program and enjoy high quality protection against all risks. This type of cover applies in the event of accidental loss or damage to your electrical appliance or equipment. It offers protection to both individuals and business owners Contact us today to get a quote.

All Risks Insurance is the most comprehensive form of Insurance

Additional coverage

Aimed at Owners or Renters of Electronic Equipment such as Computers, Medical Equipment, Communication Systems, Radio or TV Station Installations etc.

It covers loss or damage to electronic devices as a result of a sudden and unforeseen incident that is not excluded.

It may also cover:

The start and end of the coverage is determined in the Table of the Insurance Contract. The duration of the insurance is 12 months, unless another insurance period is agreed between the two parties.

The insurance premium is paid on the date of entry into full force, to the Company, either check, cash, Direct Debit, Credit /Debit card, or Standing Order. In case it is agreed that the payment of the premium will be made in instalments, the premium is paid according to the dates specified in the insurance table of the Policy.

Electrical equipment insurance is a type of insurance policy that provides cover for damage or loss to electronic equipment from any cause that is not excluded, for example fire, lightning, explosion, windstorm, hail, flood, vandalism, theft, etc. This type of insurance is important for businesses that rely on electronic equipment for their operations, as it provides them with protection against financial losses that may be caused by the destruction or damage to their equipment.

Electronic equipment insurance can offer many benefits to businesses and individuals who own and use electronic equipment. First and foremost, an electronic equipment insurance provides financial protection in the event of an accident, or other unexpected event. This type of insurance can help cover the cost of repairing or replacing damaged equipment, as well as cover other related losses that may result from the incident.

The cost of electronic equipment insurance depends on a number of factors, including the type of equipment, the coverage limits, the location of the equipment and the size of the risk. Contact a Trust insurance representative to provide a more accurate estimate.

Electronic equipment insurance provides protection for businesses and individuals who own or operate electronic equipment. It is aimed at owners or renters of electronic equipment, such as computers, medical equipment, communication systems, radio or TV station installations, etc.